Bennie D Waller, Alabama Center for Real Estate, The University of Alabama

bdwaller@ua.edu

August 8, 2022

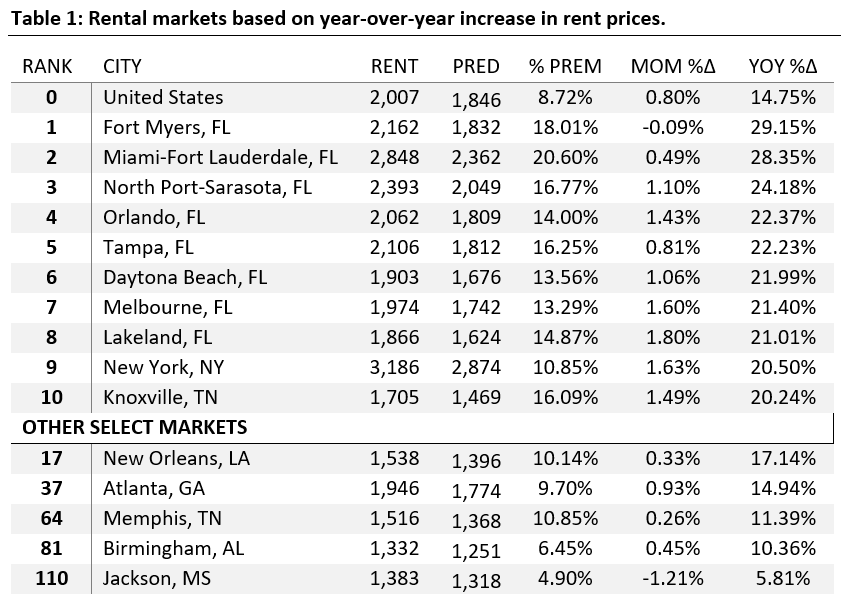

Following COVID 19, home value and rents have skyrocketed. While rents remain across the country with the highest in Florida, staking claim to 8 of the 10 most overpriced rental markets based on year-over-year changes in rent prices (see table 1). New York captures the number 9 position with Knoxville, TN rounding out the top 10 with a 20.24% increase in rents year over year as compared to Fort Myers, FL 29.15%.

This ongoing, monthly reported project is co-produced by the Florida Atlantic University Real Estate Initiative, Florida Gulf Coast University’s Lucas Institute for Real Estate Development & Finance, and the Alabama Center for Real Estate at the University of Alabama.

Using historical leasing data from Zillow’s Observed Rental Index, the researchers statistically model data from 2014 to determine where rents should be now and compare those to existing rents. The difference between current and expected rents is the premium renters are paying. The higher the premium, the more overvalued the market.

Increasing inventories quickly is difficult”, say Shelton Weeks, PhD., of FGCU’s Lucas Institute for Real Estate Development and Finance. “In addition, to the extended approval process of new development projects, a considerable headwind comes from resistance within the community to these increased levels of density”. “It is critical for municipalities to decrease the length of the approval process and increase densities to where new units can be offered at reasonable rates” he said.

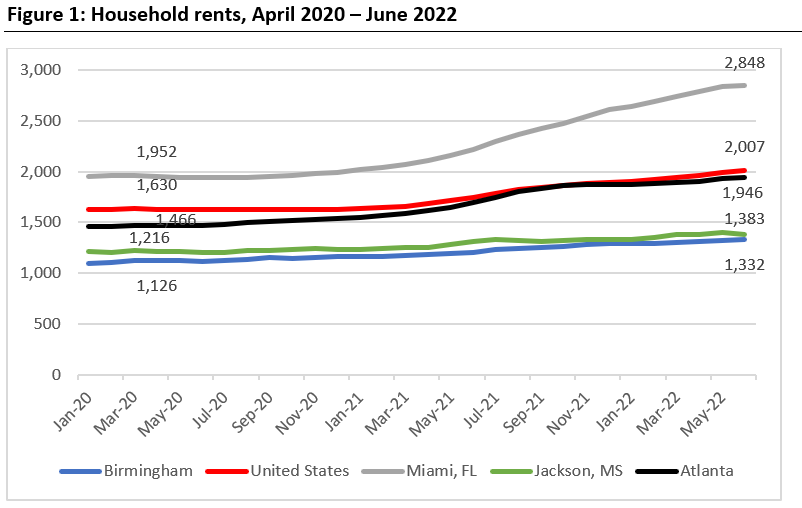

Bennie D Waller, PhD, in Culverhouse College of Business at University of Alabama points out that “many of the areas seeing the largest increases in rents are also witnessing a significant amount of migration such as cities in Florida”.

Areas such as Atlanta, GA, Birmingham, AL and Jackson, MS having little or no change in migration saw increases in rent, but at much lower rates of 33%, 18% and 14% respectively.

“Low inventories, a prolonged approval process for new construction, and rising interest rates all make for a perfect storm in keeping rental rates at high levels for the foreseeable future” says Waller.

The full data results reflect actual average rent, predicted rents, month-over-month (M-O-M) and year-over-year (Y-O-Y) percentage change in rent for each metro can found HERE.